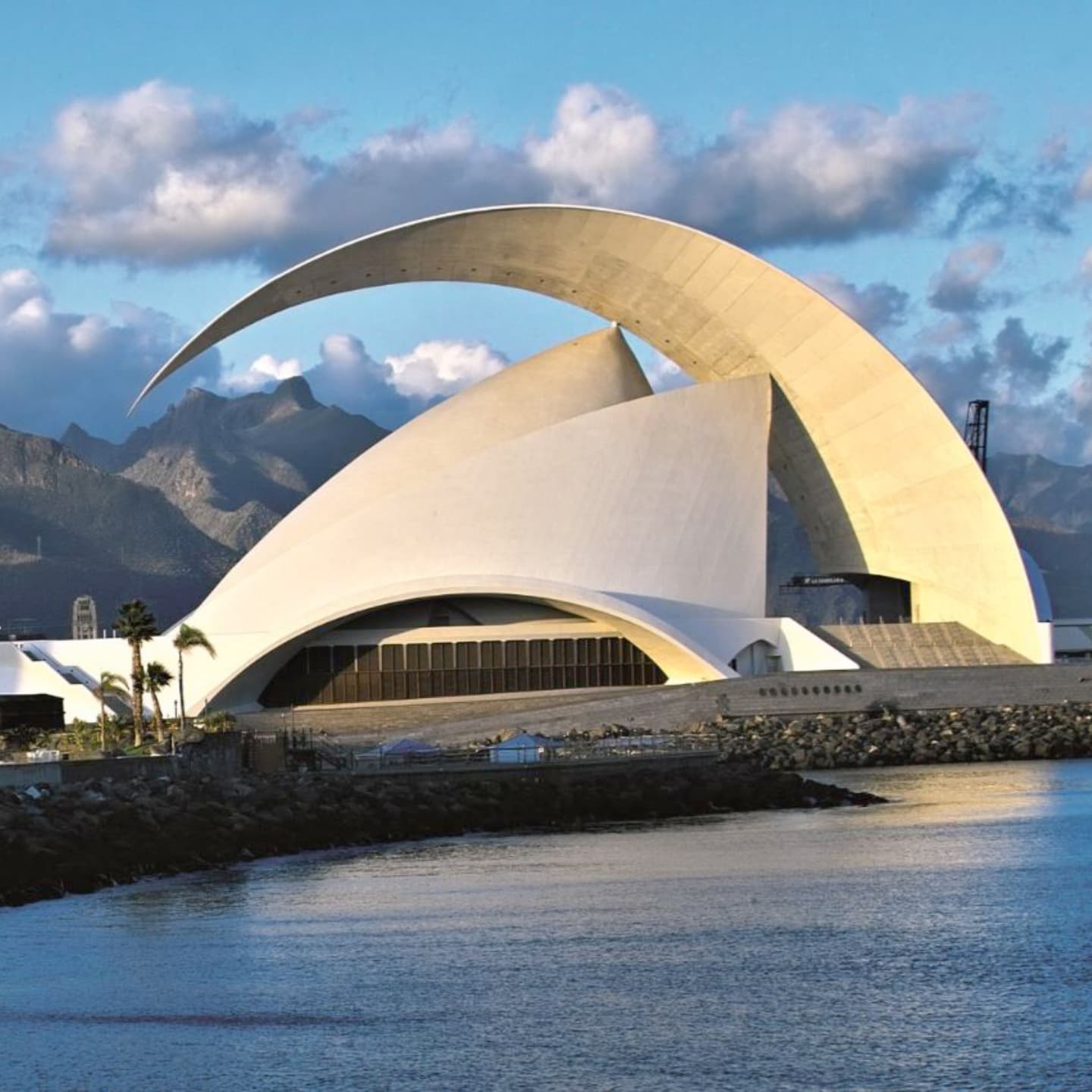

Тенерифе — любимый остров Канарского архипелага для миллионов туристов со всего мира. И это объяснимо. Несмотря на удаленность от материка, это все еще Европа — гостеприимная и по-европейским меркам весьма бюджетная Испания. Мягкий климат — зимой здесь не холодно, а летом не слишком жарко, при этом всегда есть возможность купаться в океане.

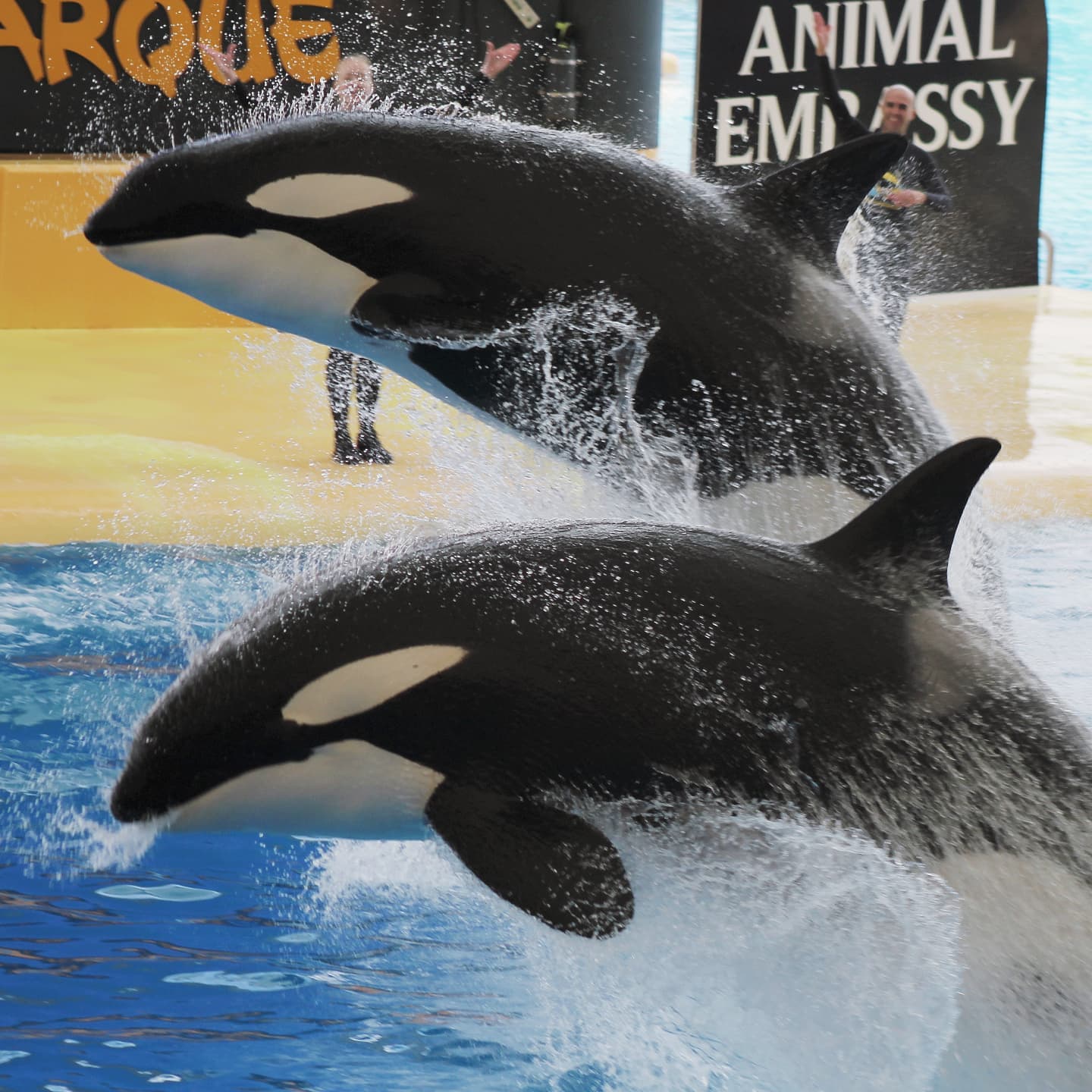

На Тенерифе множество возможностей для отдыха в самых различных форматах: начиная от отельного all inclusive до экстремальных видов спорта и эко-туризма. Природное разнообразие острова, гастрономия и культура виноделия, лучшие в мире парки, безусловно, заслуженно высоко ценятся путешественниками.

На этом сайте вы найдете описания достопримечательностей Тенерифе и информацию о том, как их посетить самостоятельно или на экскурсии с частным гидом.

Мы предлагаем познакомиться с Тенерифе в увлекательном и комфортном формате индивидуальной экскурсии с русскоязычным гидом, который по-настоящему любит остров и живет на Тенерифе уже более 20 лет. Все маршруты составлены так, чтобы вы смогли увидеть максимум интересного, попробовали лучшую местную еду и получили самые лучшие впечатления от поездки, так, чтобы Тенерифе стал одним из тех мест, куда вы захотите вернуться еще не один раз.

Александр Причислый

Профессиональный гид на Тенерифе

Я живу на Тенерифе более 20 лет и имею испанское гражданство.

Провожу индивидуальные и групповые экскурсии, гастрономические и винные туры, оформляю билеты на любые мероприятия (посещение парков, морские прогулки, дайвинг и т.д.).

Каждая экскурсия выполняется в соответствии с вашими пожеланиями и бюджетом, но всегда так, чтобы у вас остались самые лучшие впечатления об отдыхе на Канарских островах.